Mobile homes depreciate over time, unlike other forms of real estate. Because the tax assessment system makes no provision for that reality, mobile home taxes are accurate only in the first years after purchase, and become increasingly inaccurate each year thereafter.

Ultimately, some of these homeowners end up with a tax liability several times higher than reasonably expected. Mobile homes are the only form of property that requires periodic assessment appeals to maintain equitable agreement to actual value.

Since 2019, the United Way Mobile Home Tax Reassessment Program has:

- Assisted in 1,052 successful appeals

- Collectively saved these mobile home owners $10 million over the next 10 years that they should never have owed to begin with if not for a flaw in the state tax code.

- Lowered these 1,052 mobile home assessments by nearly 66% from $35 million to their actual assessed value of $11.8 million

- Saved each mobile home owner an average of $882 on their annual taxes

Chester County United Way has partnered with Legal Aid of Southeastern Pennsylvania to continue this important work and scale it to assist all mobile home owners in Chester County who may be in a similar situation.

To be considered for the 2026 reassessments, please fill out the form below:

How to Apply

To be considered for the 2026 reassessments, please fill out this form or call:

• 877-429-5994 (English) • 610-436-4510 (Spanish)

We will contact you to schedule your intake appointment in Spring 2026. Below is how the process is handled:

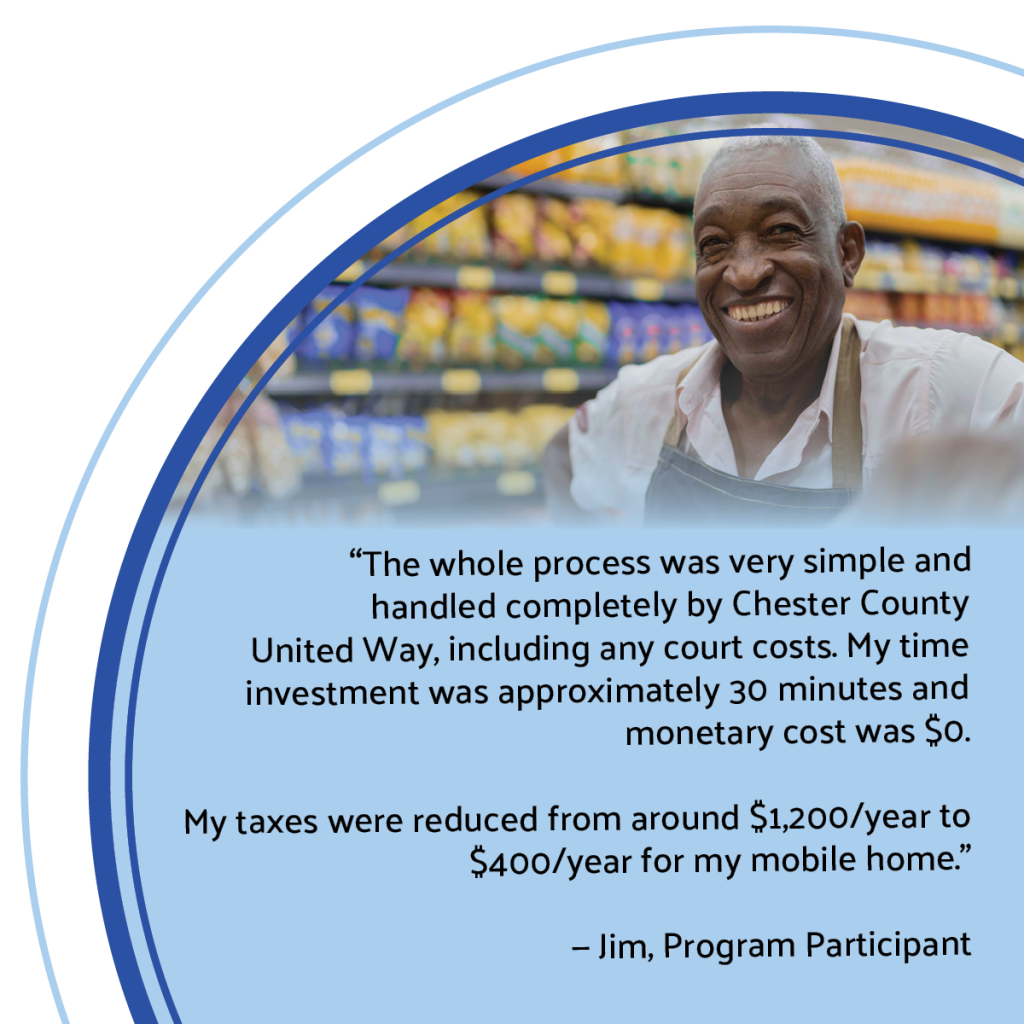

- Once the form is complete, we will contact the client to schedule a 30-minute intake interview between March and mid-July with a representative from Legal Aid of Southeastern Pennsylvania

- The paralegal will complete the forms and will contact the client for their signature

- A Chester County United Way volunteer will take photos of the home for documentation

- All forms will be submitted between May 1- August 1 to the County Reassessment Office

- Clients will be notified of the results of their reassessment appeals in October

We will do all the work and pay the fees on behalf of the homeowners in the program.

Recently appealed your taxes? Use this table to determine if you need to appeal this year:

| If your home is… | Then you should reappeal every… |

|---|---|

| 5 years old or less | 2 years |

| 5-10 years old | 3 years |

| 10 or more years old | 5 years |