Working families with income above the Federal Poverty Level, but not high enough to afford basic household necessities.

Understanding ALICE

ALICE stands for Asset Limited, Income Constrained, Employed. These are households that make more than the Federal Poverty Level but still don’t earn enough to cover the basic cost of living in their area, known as the ALICE Threshold. Households below this threshold struggle to afford essentials like housing, food, healthcare, and transportation.

While United Ways have always known ALICE, and have in fact been serving the ALICE population for decades, there was never a good measure to quantify just how many Pennsylvania households were struggling to make ends meet for their most basic needs. United Ways wanted to give this population a voice which is backed by data, to help us all understand the hardships ALICE is facing.

With the cost of living higher than what most people earn, ALICE households live in every county in Pennsylvania and they include women and men, young and old, of all races and ethnicities.

Financial Hardship in Chester County

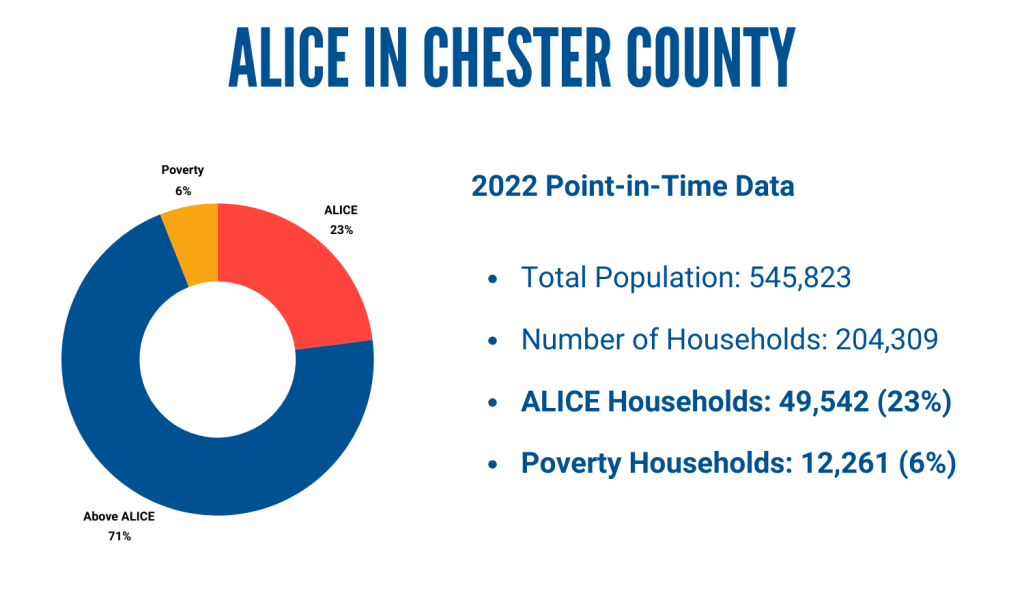

Recent findings from the ALICE® project, a comprehensive statewide initiative led by the United Way of Pennsylvania and supported by United Ways across the state, reveal that approximately 59,876 households in Chester County, accounting for 29% of the population, are facing difficulties in affording essential necessities. Coupled with those under the poverty line, nearly a third of households in Chester County face financial hardship.

Economic conditions can cause households to move above or below the ALICE Threshold. During the COVID-19 pandemic, factors like higher wages, inflation, and additional pandemic assistance impacted household finances significantly.

This information highlights the ongoing economic challenges faced by many families in Chester County, despite its overall prosperity.

OUR RESPONSE

United Way of Chester County is always working to help ALICE through our Community Impact & Innovation Fund and special initiative work:

Mobile Home Tax Reassessment

Mobile homes are the only form of property that require periodic assessment appeals to maintain equitable agreement to actual value. We have partnered with Legal Aid of Southeastern Pennsylvania to assist clients throughout the entire process. Our goal is to assist all mobile home owners in Chester County who may be in a similar situation. To learn more, click here.

Volunteer Income Tax Assistance (VITA) Program

We have expanded our partnership with Life Transforming Ministries (LTM) to help spread the reach of their VITA program. This program offers free tax preparation help to low and moderate-income households and also draws attention to the Earned Income Tax Credit (EITC), a federal credit that ranges from $503 to $6,242 depending upon household income and size.

United Way Financial Stability Center

Through our service navigators and coaches, we provide extensive support and resources, professional guidance, confidential counseling and a set of services to help you clarify and achieve your financial goals. To learn more, click here.