Staff Spotlight: Edwina Johnson

Meet Edwina Johnson, Donor Services Administrator at United Way of Chester County. Learn more about her integral role at UWCC and what work she is most proud of by watching the video below.

Community Connection: Downingtown Area Summer Hoops

Inspired by the wonderful results of Citadel Credit Union’s diaper drive, Downingtown Area Summer Hoops (DASH) was motivated to start their own drive.

Thank you for helping to make Chester County Stronger!

To learn more about how your business or organization can run a similar drive, contact Doug Kaiser, Director of Resource Development, at 610.429.9400 ext. 4102.

Know Someone That Owns a Mobile Home in Chester County?

United Way of Chester County will be offering $10 Wawa gift cards to the first 100 people who refer a person that successfully completes the Mobile Home Tax Reassessment application.

Hurry – offer only lasts until July 15, 2021 or until we run out of gift cards!

To learn more about the Mobile Home Tax Reassessment project, click here or contact Darshana Shyamsunder, Director, Community Impact Initiatives, at 610.429.9400 ext. 4112.

To learn how you can financially support this project, contact Doug Kaiser, Director of Resource Development, at 610.429.9400 ext. 4102.

Save the Date!

Citadel presents

Live United in Music

Benefitting the United Way of Chester County Impact & Innovation Fund

September 30, 2021 – 5:30pm

Penn Oaks Golf Club, 150 Penn Oaks Drive, West Chester, PA

For more information, tickets, and sponsorship opportunities – visit our website at LiveUnitedInMusic.org.

You’re Invited! 2021 United Way Kickoff & Annual Meeting

As a valued fighter for Chester County, you are cordially invited to join us.

July 14, 2021 11:30 am to 1:00 pm

Penn Oaks Golf Club, 150 Penn Oaks Drive, West Chester, PA

$30 per person

Join us as we celebrate the impact of the United Way of Chester County over the past year during these extraordinary times and help us kick off our new 2021 United Way Campaign.

This event is open to anyone and all are invited to attend! Please RSVP by July 9. Click here to register.

United Way Financial Stability Center Partner Highlight: Clarifi

With the help of our partners, United Way Financial Stability Center helps clients navigate a path towards a more secure financial future

Clarifi helps its clients reach their most important goals through financial education, counseling,

and other support services through a holistic approach. Clarifi believes that pathways to financial wellness should be accessible to everyone.

“Clarifi’s mission is to empower individuals to achieve financial resiliency,” said Stephen Gardner, Executive Director, Clarifi. “Our partnership with United Way of Chester County and the Financial Stability Centers supports that mission.”

This organization offers a variety of programs for clients at the United Way Financial Stability Center, including financial counseling and community education. Clarifi’s certified counselors can help create a budget, manage debt, improve credit score, housing success, eviction prevention, and how to build savings.

Clarifi clients make real progress. 2020 was an extremely difficult year as the COVID-19 pandemic made it impossible for Cathy, a Clarifi client, to return to her normal job. Prior to the pandemic, Cathy worked part-time at a sports complex, in addition to pick-up hours for other outdoor events held at the complex. Cathy’s counselor created a crisis budget with her in April while she was awaiting her unemployment benefits. After a couple budget conversations, and realizing all of her expenses are covered without needing to use the extra pandemic unemployment compensation, Cathy’s and her counselor talked about opening up a separate account with limited access, no debit card or ability to transfer easily to or from her checking account in her banking app. As of August 2020, she has opened a high-yield savings account and deposited almost two months of unemployment income totaling close to $5,000!

To learn more about Clarifi, click here or call 800-989-2227. To learn how you can financially support the United Way Financial Stability Center, contact Doug Kaiser, Director of Resource Development, at 610.429.9400 ext. 4102.

Meet ALICE

ALICE can be an office worker, a child care worker, a personal care aide or nursing assistant, an elementary school teacher, a waitress, a retail associate or a custodian. ALICE is every gender, race, age and ethnicity.

The rising cost of household essentials and the increase in low-wage jobs have caused a rapid increase in the number of ALICE (an acronym for Asset Limited, Income Constrained, Employed) households in our community.

The Chester County average ALICE Household Survival Budget is $26,016 for a singleindividual, and $78,720 for a family of four with one infant and one preschooler. Thistranslates to an hourly wage of $11.77 for the single adult and $34.82 in total householdhourly wage, for the family of four.

Although Chester County is the wealthiest county in Pennsylvania, there is still a poverty rate of 7%. The real need in our community becomes clearer when we consider there is an additional 20% rate of ALICE households. Coupled with those under the poverty line, more than 1 in 4 Chester County residents are unable to make ends meet.

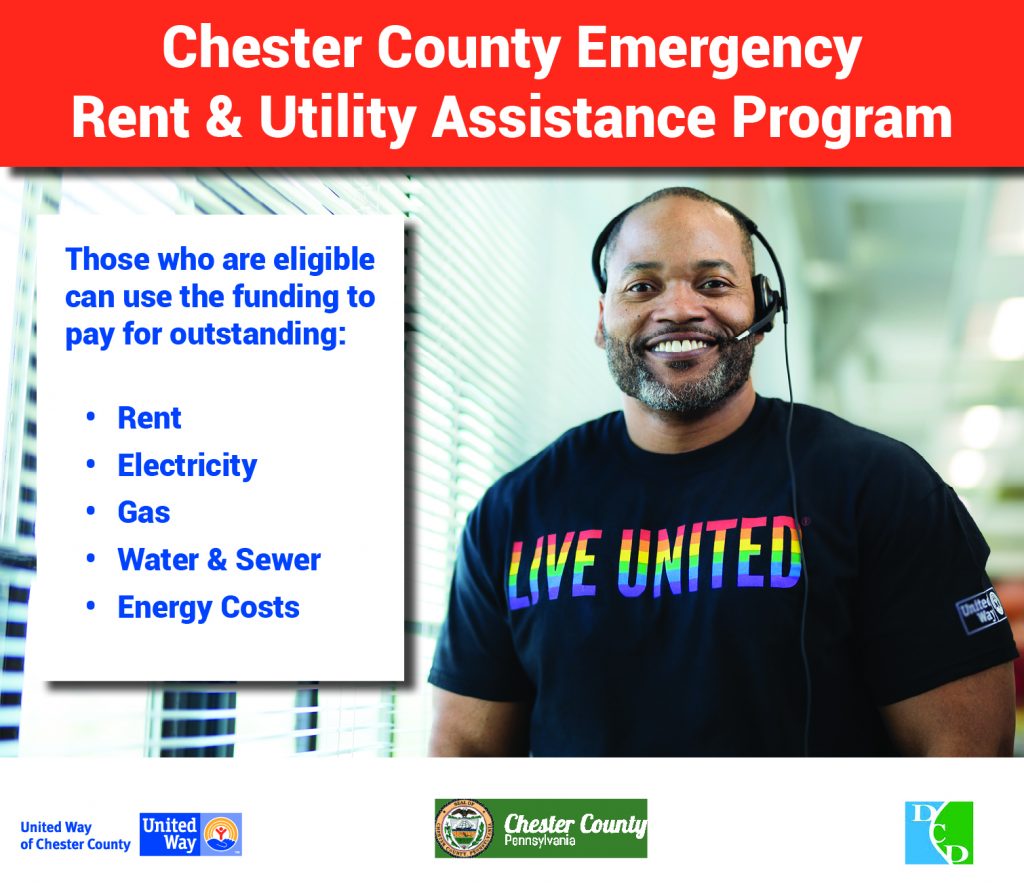

One way the County and United Way are helping ALICE is through the Emergency Rent & Utility Assistance Program. This program serves Chester County residents and can only be accessed by dialing 2-1-1.

Need assistance? Please follow the three steps below:

- Press 2 for Homelessness and Housing Crisis

- Press 2 for Chester County

- Press 2 for Emergency Rental Assistance Program

Funding will serve individuals and families that are obligated to pay rent and meet the following criteria:

- Households obligated to pay rent.

- Qualified for unemployment or have experienced financial hardship due, directly or indirectly, to the COVID-19 outbreak.

- Have a household income at or below 80 percent of the area median (income limits are subject to change per guidance from the federal government).

Once the client has contacted 2-1-1 for intake and referral, they will need to gather information for submission. Those who are eligible can use the emergency rent and utility funding to pay for outstanding rent, electricity, gas, water, and sewer; and energy costs such as fuel oil or propane, over a 15-month period.

To learn more about this program, click here.

To learn more about ALICE, click here. To learn how you can financially support ALICE, contact Doug Kaiser, Director of Resource Development, at 610.429.9400 ext. 4102.