United Way of Chester County is continuing its important Mobile Home Tax Reassessment initiative and has an ambitious goal of completing 500 successful appeals this year, an increase of 50% over the 333 completed last year at the start of the pandemic. Partnering with Legal Aid of Southeastern Pennsylvania, LCH Health and Community Services (previously known as La Comunidad Hispana) and local food pantries, the Mobile Home Tax Reassessment program offers assistance to mobile home owners in Chester County to file property tax reassessment appeals.

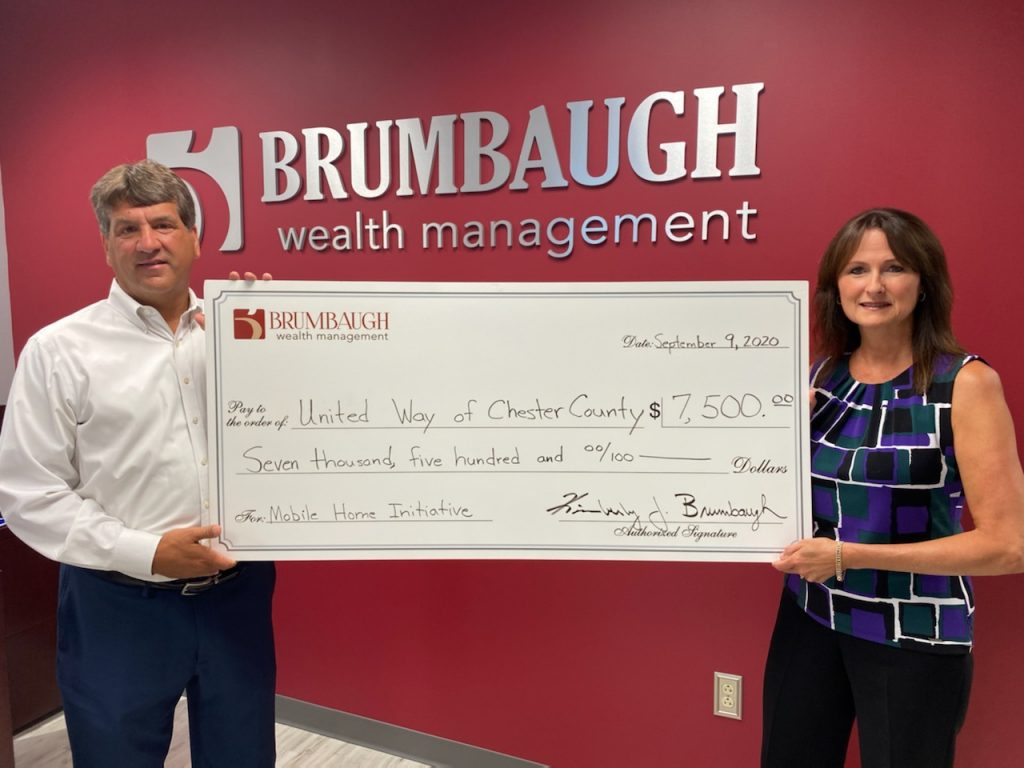

Unlike your standard home, a mobile home depreciates like a car rather than appreciating like a house. So with its value dropping approximately 3% per year, it very quickly gets over assessed. To address this issue and at the encouragement of Randy Blough, a volunteer at the Honey Brook Food Pantry, United Way of Chester County created the Mobile Home Tax Reassessment Project. UWCC and its program partners complete and file the appeal, including payment of the book valuation (appraisal) and county filing fees, and representatives from Legal Aid of Southeastern Pennsylvania attend the appeal hearing for the client. The client does not have to face the appeal board – this program does that for them. And the entire project to date has been funded through the generosity of donors including Brumbaugh Wealth Management, Di & Dallas Krapf, Delphi Wealth Management, G.A. Vietri Inc. and the County of Chester.

“Our firm has always had a heart to support our community,” said Kimberly J. Brumbaugh, Founder & CEO of Brumbaugh Wealth Management. “Learning about our neighbors’ tax situation in paying higher taxes than they should for a home that consistently depreciates year after year doesn’t seem fair. We appreciate the United Way of Chester County’s diligence in wanting to help residence ‘correct’ and reduce this expense that is truly a burden for them.”

“This initiative has saved hundreds of thousands in taxes and penalties that should have never been owed to begin with, if not for a flaw in the state tax code that requires that mobile homes be taxed like a house,” said Christopher Saello, President and CEO of United Way of Chester County. “Even further, estimates suggest that approximately 40% of all mobile and manufactured homes are in land lease communities, which devalues their worth even further.” United Way of Chester County worked with Chester County officials to simplify the lengthy process for mobile home owners, and has been educating and advocating to local and state government officials to help assist in fixing the problem at the state level.

In just two years, the United Way Mobile Home Tax Reassessment program has made great impact:

• Assisted in 510 successful appeals

• Lowered these 510 mobile home assessments by 70% from $18 million to their actual assessed value of $5 million

• Saved each mobile home owner an average of $966 on their annual taxes

• Collectively saved these mobile home owners $4.9 million over the next 10 years that they should have never owed to begin with if not for a flaw in state tax code.

This innovative program is believed to be the only one of its kind in the United States, and United Way Worldwide’ s Innovation team recently did a case study on the project that was shared with over 1,100 United Ways nationally. The program also received a runner up award for Housing Development Innovation by the Social Innovations Journal.

Although progress has been made, there is still work to do. There are 3,600 mobile homes in Chester County and only 19% have been reassessed in the past 5 years. Despite the pandemic, United Way of Chester County has set an aggressive goal of accomplishing 500 reassessments this year.

What is the process to apply?

To be considered for the 2021 reassessments, visit www.UnitedForMobileHomes.com and fill out the 2021 reassessment form. Once the form is complete:

• United Way of Chester County will contact the client to schedule an intake appointment with a representative from Legal Aid of Southeastern Pennsylvania. The deadline to fill out this form is July 10, 2021 as the Chester County Reassessment filing window is May 1- August 1.

• A paralegal will complete the forms and will contact the client for their signature.

• A volunteer from United Way of Chester County will take photos of the home for documentation.

• All forms will be submitted between May 1- August 1, 2021 to the County Reassessment Office.

• Clients will be notified of the results of their reassessment appeals in October 2021.

United Way of Chester County and its partners will do all the work and pay the fees on behalf of the homeowners in the program. To learn more about the Mobile Home Tax Reassessment project, view a video about it, participate in the project or make a donation to support it, visit www.UnitedForMobileHomes.com or call 610-429-9400.